Mission

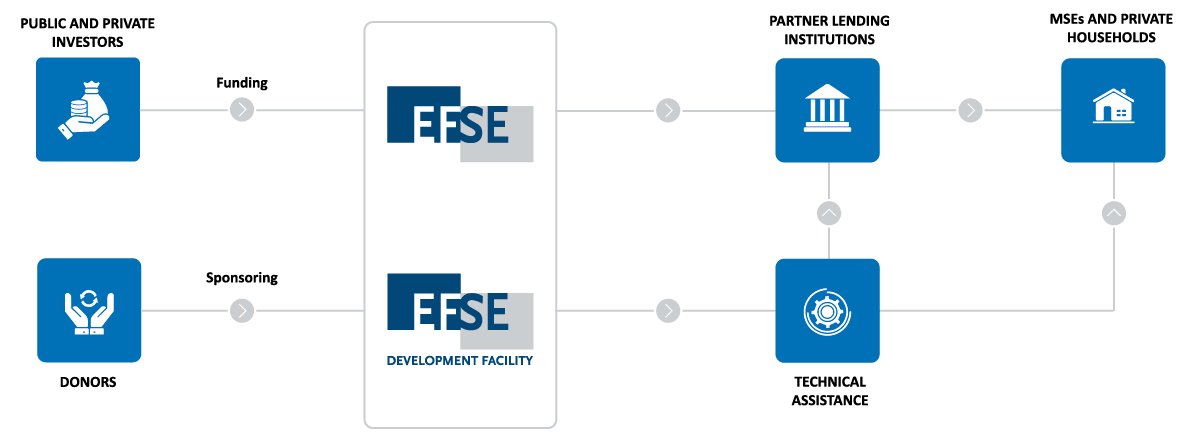

The European Fund for Southeast Europe (EFSE) aims to foster economic development and prosperity in Southeast Europe and the Eastern Neighbourhood Region by investing in the success of micro, small and medium enterprises as well as improved living conditions for private households.

Approach

EFSE invests in carefully selected local financial intermediaries for on-lending to micro, small and medium enterprises and private households. These investees include commercial banks, microfinance institutions, and non-bank financial institutions such as leasing companies.

In addition, the EFSE Development Facility provides technical assistance, training, and other non-financial support to institutions and individuals to anchor and multiply the fund's impact. Together, EFSE and its Development Facility build an environment that fosters sustainable entrepreneurship.

Please click on your country of interest.

Albania

Active Number of Partner Institutions: 1

Partner Institutions: FED Invest

Cumulative volume of sub-loans since inception: EUR 137,403,455

Number of active end-borrowers: 413

Development Facility project volume: EUR 3,426,357

Armenia

Active Number of Partner Institutions: 4

Partner Institutions: ACBA, ACBA Leasing, Araratbank, Inecobank

Cumulative volume of sub-loans since inception: EUR 809,362,070

Number of active end-borrowers: 1,715

Development Facility project volume: EUR 2,404,687

Azerbaijan

Active Number of Partner Institutions: 2

Partner Institution: AccessBank, Bank Respublika

Cumulative volume of sub-loans since inception: EUR 246,393,924

Number of active end-borrowers: 792

Development Facility project volume: EUR 1,013,618

Belarus

Active Number of Partner Institutions: 1

Partner Institutions: BNB - Belarusky Narodny Bank

Cumulative volume of sub-loans since inception: EUR 86,534,584

Number of active end-borrowers: -

Development Facility project volume: EUR 261,892

Bosnia and Herzegovina

Active Number of Partner Institutions: 11

Partner Institutions: MCC EKI, MCC Partner, MCF Partner, MF Banka, MI-BOSPO, Mikrofin, NLB Banka Sarajevo, Raiffeisen Bank BA, Raiffeisen Leasing, Sparkasse Bank d.d. BiH, Sparkasse Leasing BiH

Cumulative volume of sub-loans since inception: EUR 862,528,669

Number of active end-borrowers: 12,349

Development Facility project volume: EUR 7,273,278

Bulgaria

Active Number of Partner Institutions: 2

Partner Institutions: Allianz Bank Bulgaria, ProCredit Bank BG

Cumulative volume of sub-loans since inception: EUR 106,261,475

Number of active end-borrowers: 382

Development Facility project volume: EUR 196,586

Croatia

Active Number of Partner Institutions: 1

Partner Institutions: Hrvatska Poštanska Banka

Cumulative volume of sub-loans since inception: EUR 24,630,301

Number of active end-borrowers: 1

Development Facility project volume: EUR 1,319,952

Georgia

Active Number of Partner Institutions: 10

Partner Institutions: Bank of Georgia, Basisbank, BGEO Group, Credo, Crystal Micro Financial Organisation, Lazika Capital, Micro Business Capital, Pro Credit Bank GE, TBC Bank, TBC Leasing GE

Cumulative volume of sub-loans since inception: EUR 1,525,019,290

Number of active end-borrowers: 23,243

Development Facility project volume: EUR 4,784,612

Kosovo

Active Number of Partner Institutions: 4

Partner Institutions: AFK Kosovo, BKT Kosovo, KEP Trust, KRK

Cumulative volume of sub-loans since inception: EUR 371,690,122

Number of active end-borrowers: 9,811

Development Facility project volume: EUR 3,828,822

North Macedonia

Active Number of Partner Institutions: 4

Partner Institutions: Halkbank MK, Horizonti, ProCredit Bnk MK, Sparkasse Bank MK

Cumulative volume of sub-loans since inception: EUR 217,138,545

Number of active end-borrowers: 1,317

Development Facility project volume: EUR 1,424,017

Moldova

Active Number of Partner Institutions: 4

Partner Institutions: BT Leasing MD, MAIB, OTP Bank MD, Victoriabank SA

Cumulative volume of sub-loans since inception: EUR 203,754,812

Number of active end-borrowers: 1,296

Development Facility project volume: EUR 3,551,749

Montenegro

Active Number of Partner Institutions: 3

Partner Institutions: Alter Modus, CKB, Erste Bank Podgorica

Cumulative volume of sub-loans since inception: EUR 281,108,539

Number of active end-borrowers: 2,686

Development Facility project volume: EUR 1,656,709

Romania

Active Number of Partner Institutions: 9

Partner Institutions: AgGRICOVER CREDIT IFN, Banca Transilvania, BT Microfinantare, Garanti Leasing RO, LIBRA INTERNET BANK SA, Patria Bank SA, Patria Credit IFN, ProCredit Bank RO, Vitas Romania

Cumulative volume of sub-loans since inception: EUR 1,562,539,986

Number of active end-borrowers: 16,242

Development Facility project volume: EUR 2,989,922

Serbia

Active Number of Partner Institutions: 5

Partner Institutions: 3 Bank, Eurobank Direktna, OTP Banka Serbia, Procredit Bank RS, UniCredit Bank RS

Cumulative volume of sub-loans since inception: EUR 1,507,713,508

Number of active end-borrowers: 7,556

Development Facility project volume: EUR 3,235,764

Turkey

Active Number of Partner Institutions: 9

Partner Institutions: Akbank, Denizbank, Garanti Bank, Garanti Leasing TR, QNB Finans Leasing, QNB Finansbank, Yapi Kredi Leasing, Yapı ve Kredi Bankası A.Ş.

Cumulative volume of sub-loans since inception: EUR 1,933,261,358

Number of active end-borrowers: 6,478

Development Facility project volume: EUR 4,640,132

Ukraine

Active Number of Partner Institutions: 7

Partner Institutions: Agroprosperis Bank, Bank Lviv, Credit Agricole Bank, Kredobank, OTP Leasing, Piraeus Bank UA, ProCredit Bank UA

Cumulative volume of sub-loans since inception: EUR 363,526,779

Number of active end-borrowers: 1,282

Development Facility project volume: EUR 3,638,962

SOUTHEAST EUROPE

European Eastern Neighborhood Region

Who Does EFSE Finance?

EFSE provides funding to local financial institutions that have confirmed their commitment to the fund's mission, and which have the capacity to reach entrepreneurs and private households. By supporting the ability of these financial intermediaries to serve EFSE's target group, the fund is not only amplifying its impact through the utilization of local financial infrastructure, it is also strengthening the ability of the financial sector in these regions to advance sustainable development in the long term..

EFSE provides 3 types of loans to its financial intermediaries. These are then used for on-lending for one or more of the following predefined purposes:

- Micro, small and medium enterprises finance

- Financing for rural areas

- Housing finance

EFSE in numbers

Key figures as of Q4 2023

Key figures since inception of the Development Facility in 2006

Blended finance for more impact

EFSE was one of the first impact investment vehicles to pioneer a public-private partnership model. This layered and blended finance structure leverages public contributions as a risk cushion to mobilize private investments and thus unleashing more resources for impact. As a result, public investors can achieve more social and economic development for their money, and private investors can enter markets that may otherwise have been viewed as too risky to enter alone.

Local currency for local business

Local currency lending is a key element of responsible finance: When borrowers can invest in their home or business using the same currency as their income, they are protected from potentially hazardous ups and downs in exchange rates. EFSE has dedicated instruments to absorb this currency risk so that investees do not have to. The European Union and the German Federal Ministry for Cooperation and Development (BMZ) both contributed to a special fund layer for this purpose: the L-shares. EFSE is now active in spreading this responsible financing practice, as well as the awareness of its importance.

Innovations for financial inclusion

EFSE has a solid 15-year track record and a reputation as a stalwart partner in the region. But it is also an agile agent of innovation. Itself a pioneer, EFSE seeks out high-potential new developments, such as in fintech, to increase financial inclusion and supports entrepreneurs and partners alike with the development and implementation of new technologies.

In-region offices for on-the-ground presence

EFSE is active in 16 countries in Southeast Europe and the EU Eastern Neighbourhood. Our local experts work from in-region offices close to our clients and networks. EFSE's deep understanding of the markets where we are active comes from working side-by-side with investees, partners, national regulators, and entrepreneurship organisations to provide tailored support for local needs.

Technical assistance for systemic impact

EFSE's financial investments are complemented by technical assistance provided by the EFSE Development Facility. Because making a lasting difference means building an environment where positive impact can take root: The Development Facility works with institutions and individuals alike to build capacities, train skills, connect ecosystem players, study the market, and build a culture of entrepreneurship and responsible finance.

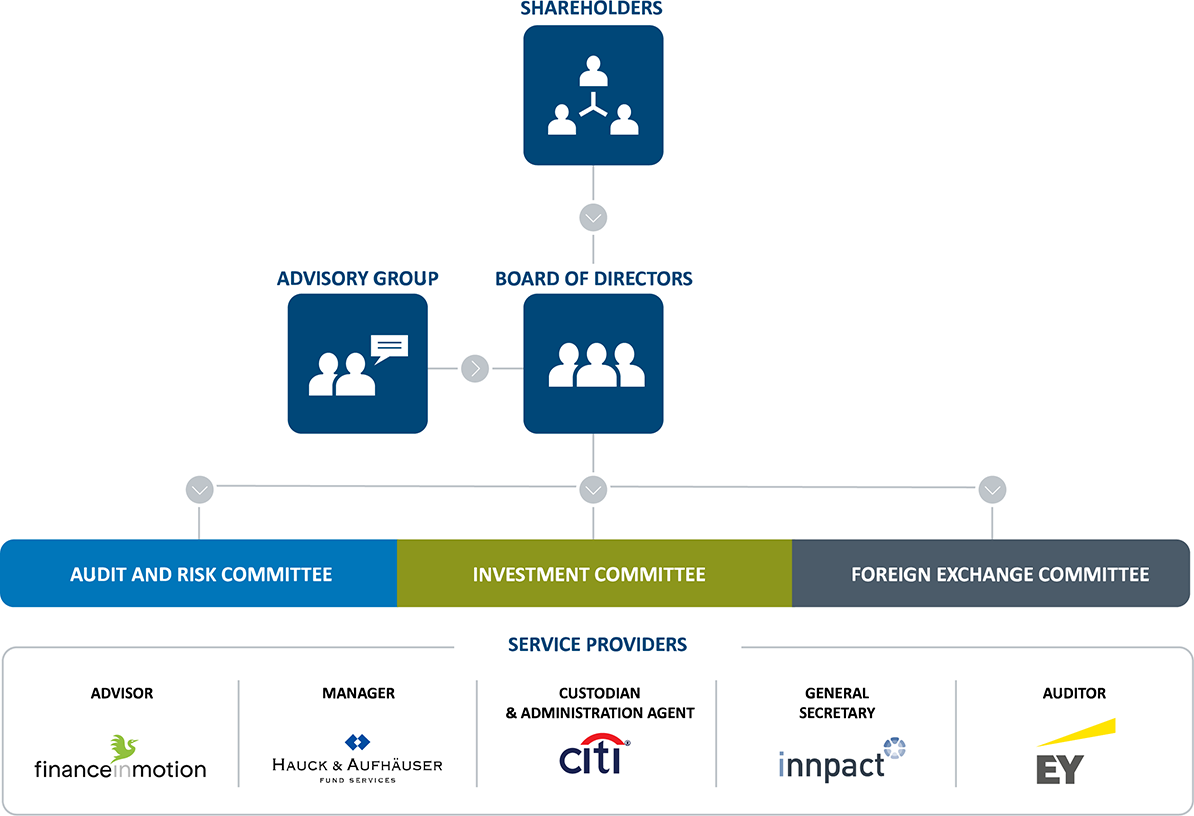

Corporate Governance

EFSE's governance is based on a solid foundation and transparent processes. EFSE is set up as a SICAV-SIF under Luxembourg law, a proven vehicle for numerous impact investment funds.

The Board of Directors, appointed by the fund's shareholders, is EFSE's main decision-making body. The Investment Committee approves investment proposals submitted by the fund's advisor, Finance in Motion. The members of the EFSE Investment Committee are appointed by the Board of Directors.

General Shareholder Assembly

The public investors into EFSE's first-loss shares form the fund's shareholder base, including fund initiator KfW, the European Commission, the German Federal Ministry for Cooperation and Development, and more. Private investors include impact-minded institutions such as ethical banks, pension funds, family offices, and more.

Board of Directors

The EFSE Board of Directors are representatives elected by the shareholders to exercise oversight of the fund and determine its strategic direction and approach.

Advisory Group

This forum for central bank representatives of the countries where EFSE is present provides a platform for sharing local developments, experiences, and policy recommendations.

Audit & Risk Committee

Appointed by the Board, this committee is responsible for the fund's internal controls, accounting integrity, and risk management process.

Investment Committee

The Board of Directors appoints an Investment Committee comprising experts in the field of development finance. The Investment Committee approves all investments made by EFSE.

FX Committee

The Board also appoints an FX Committee to vet pricing and other matters pertaining to the fund's local currency investments made utilising its "L-Share" class.

Manager

Hauck & Aufhäuser Fund Services S.A. is responsible for cash planning, direct operating expenses, FX monitoring, coordinating external tax advisors and hedging counterparties, and other management services under Luxembourg law.

Advisor

The Advisor, Finance in Motion GmbH, is the implementing arm of the fund, working directly with the Board and Committees to propose investments, advise on strategies, liaise with investors and investees, and carry out the decisions of the Board and Committees.

EFSE'S HISTORY